Struggling with restricted payment gateways? SecurePay Bridge is your workaround.

💡 SecurePay Bridge – The Smart Solution for High-Risk Payments

SecurePay Bridge helps online stores facing payment gateway challenges by securely redirecting payments to a trusted partner store. Customers complete the payment smoothly and return automatically — no interruptions, just seamless transactions.

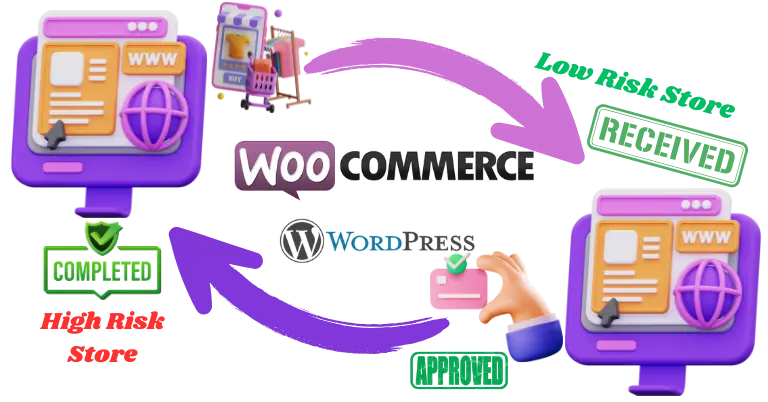

SecurePay Bridge is an innovative system built on a dual-plugin structure for WooCommerce. It enables high-risk online stores to process payments securely through an intermediary gateway hosted on a low-risk site. Instead of facing limitations, SecurePay Bridge seamlessly redirects customers from your primary site (Site A) to a trusted secondary site (Site B) for payment processing, then returns them to your store once the order is complete – all without disrupting the user experience.

Imagine: You run a digital store unable to use standard gateways like PayPal or Stripe. With SecurePay Bridge, your customer checks out normally. Behind the scenes, the payment occurs on a different trusted site, and everything stays perfectly synchronized.

- Avoid account bans or payment holds often associated with high-risk businesses.

- Increase conversion rates by offering a smooth checkout, even with provider limits.

- Save valuable time with fully automated order and status syncing between sites.

🔐 How It Works: A Simple Flow

1. The customer selects the SecurePay Bridge gateway at checkout on Site A (Your Store).

2. They are securely redirected to Site B (Partner Store) to complete the payment.

3. Order status is automatically synced between both sites via API.

4. The customer is seamlessly returned to Site A to view the order confirmation page.

Visual Payment Flow:

sequenceDiagram

participant C as Customer

participant SA as Site A (Your Store) /* <-- SIMPLIFIED LABEL */

participant SB as Site B (Partner Store) /* <-- SIMPLIFIED LABEL */

participant PG as Payment Gateway /* <-- Kept PG simple */

participant API as Secure API Link

C->>SA: 1. Browse & Add to Cart

C->>SA: 2. Proceed to Checkout

C->>SA: 3. Select "SecurePay Bridge"

Note over SA: Prepare secure redirect data

SA->>C: 4. Redirect Browser to Site B

C->>SB: 5. Arrives at Site B Checkout

Note over SB: Receive data, Prepare Gateway

SB->>PG: 6. Initiate Payment

C->>PG: 7. Enter Payment Details

PG-->>SB: 8. Payment Confirmation

alt Payment Successful

SB->>API: 9a. Send Success Status to Site A

API-->>SA: 9b. Update Order Status on Site A

SB->>C: 10. Redirect Browser back to Site A

C->>SA: 11. View Order Confirmation (Site A)

else Payment Failed

SB->>C: 10. Show Payment Failed/Retry

C->>SA: 11. (May return to Cart/Checkout)

end

In the diagram above:

- Site A (Your Store): Refers to your main High-Risk store running WooCommerce with the SecurePay Bridge plugin.

- Site B (Partner Store): Refers to the separate Low-Risk partner store, also running WooCommerce, the SPB plugin, and the active Payment Gateway (PG).

- Payment Gateway (PG): The actual payment processor integrated with Site B (e.g., Stripe, PayPal).

- Secure API Link: Represents the communication channel used to sync order statuses between Site A and Site B.

⚙️ Key Features: Site A Plugin (Your High-Risk Site)

- Custom Payment Gateway: Appears as a native option in checkout, bridging to the external processor.

- Secure Payment Redirection: Passes order data securely via the browser to Site B – no sensitive data stored locally during transfer.

- Real-Time Order Status Updates: Uses REST API to instantly receive and sync status changes (e.g., 'processing', 'completed') from Site B back to Site A.

- Flexible Configuration: Full control over gateway activation rules, Site B connection details, and automatic update settings.

🧹 Key Features: Site B Plugin (Your Low-Risk Site)

- Order Data Reception: Securely receives data from Site A and redirects the user to a specialized checkout page, retaining all necessary order details.

- Smart Cart Logic: Dynamically selects a placeholder product based on price, category, or predefined rules, ensuring the amount charged matches Site A's order total.

- Auto-Fill Customer Data: Automatically populates billing, shipping (if applicable), and currency fields using the data passed from Site A for a faster checkout.

- Robust Order Status Sync: Reliably notifies Site A via API upon successful payment or any relevant status change on Site B.

- Seamless Return to Site A: Automatically redirects the customer back to the correct order confirmation page on Site A after successful checkout on Site B.

- Cookie & Session Cleanup: Prevents stale data or unwanted cart behavior on Site B outside the intended SecurePay Bridge flow.

🚀 What Makes SecurePay Bridge Different?

- Maintain Brand Experience: No jarring redirects to generic third-party payment pages. Customers stay within environments you control.

- WooCommerce Native: Designed specifically for WooCommerce – avoids bloat and compatibility issues common with generic solutions.

- Privacy & Compliance Focused: Built with data security, privacy regulations, and modular growth in mind.

🛠️ 100% WooCommerce Compatible

Works flawlessly with your existing WooCommerce store setup.

🗃️ Database Friendly

Requires no modifications to your core database structure.

💡 Uninterrupted UX

Provides a seamless checkout experience across both sites.

🧩 Fully Customizable

Tailor plugin settings precisely to match your store’s workflow.

🛎️ Dedicated Support

Includes technical guidance and comprehensive documentation.

🛠️ 100% WooCommerce Compatible

Works flawlessly with your existing WooCommerce store setup.

🗃️ Database Friendly

Requires no modifications to your core database structure.

💡 Uninterrupted UX

Provides a seamless checkout experience across both sites.

🧩 Fully Customizable

Tailor plugin settings precisely to match your store’s workflow.

🛎️ Dedicated Support

Includes technical guidance and comprehensive documentation.

🔎 Who Is SecurePay Bridge For?

SecurePay Bridge is the ideal solution for WooCommerce merchants operating in high-risk industries or facing gateway restrictions, who need to process transactions securely through a separate, low-risk environment. If you offer digital goods, SaaS, international services, or anything considered high-risk, this allows you to maintain a professional checkout flow while ensuring payment stability and compliance.

Perfect for:

- Businesses needing payment redirection due to specific provider restrictions or industry type.

- Subscription platforms handling complex or international recurring billing.

- Stores selling digital products, licenses, or services with unique pricing models.

- Companies requiring modular, API-integrated order synchronization across multiple WordPress/WooCommerce sites.

✅ Stop struggling with payment limitations. Start accepting payments securely, flexibly, and professionally today – even for high-risk stores.